All in one solution for invoicing compliance with Comprehensive experience

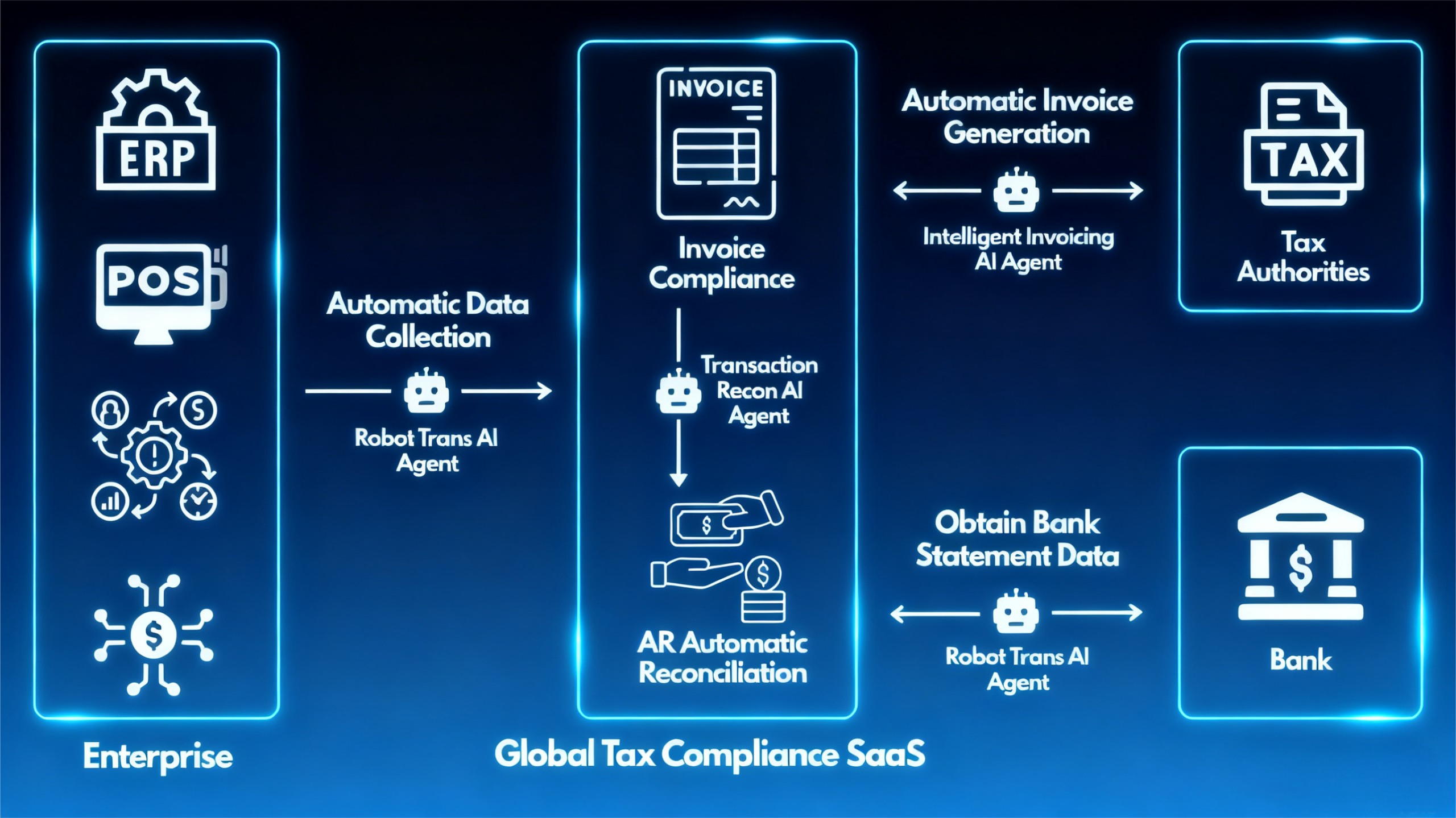

The system is built with multiple AI agents (e.g., “Intelligent Invoicing AI Agent,” “AR Auto-Reconciliation AI Agent”). Each agent is specialized in specific tasks, simulating the work of human experts to enable intelligent processing and decision-making for complex tasks.

Through AI agents (Robot Agents), data is automatically collected from various enterprise systems (ERP, POS, business systems, financial systems). This eliminates manual data entry, ensuring data accuracy at the source and high collection efficiency.

Directly integrates with tax bureau systems worldwide to enable real-time invoice authentication and submission. It also connects directly to banking systems to automatically obtain statement data, ensuring data security and timeliness.

Automates the entire process from data input to invoice generation, compliance verification, direct submission to tax bureaus, and automated reconciliation for payment confirmation. This reduces manual work by over 90%, freeing up finance teams from tedious tasks to focus on higher-value strategic work.

The SaaS model adapts to changing needs, easily supporting enterprises in rapidly expanding and expanding their business globally.

when customers request invoices, businesses can conveniently issue invoices through our e-Invoice APP.

The APP can be used independently or paired with the AI Hardware Family to enable intelligent invoicing across various scenarios. All invoice data is ultimately aggregated to the SaaS platform for unified management and delivery, providing customers with an efficient and compliant invoicing experience.